3 ways to squeeze the juice from the upcoming tax cuts

Your stage three tax cut is 90 days away.

The average person will save around $161 per month with the upcoming tax cuts.

Let’s face it, it’s pretty easy to let this money evaporate into the lifestyle creep trap (this is when your spending slowly starts to match any new income you earn, almost like your lifestyle is “creeping” up over time without you realising it).

But I don’t want you to fall victim to the ‘creep’.

Here are three practical options to consider for your tax cut dollars:

1. Save in a high interest savings account

Save $161 per month @ 5%/a for 20 years with 100% reinvestment you would have $133,394.

2. Put extra on your home loan

If you were to increase your mortgage payments by $161 per month ($550,000 Loan Balance, 6.5%/a Interest, 30 year term), you could save yourself a whopping $100,432 in interest & 3 years + 7 months in time.

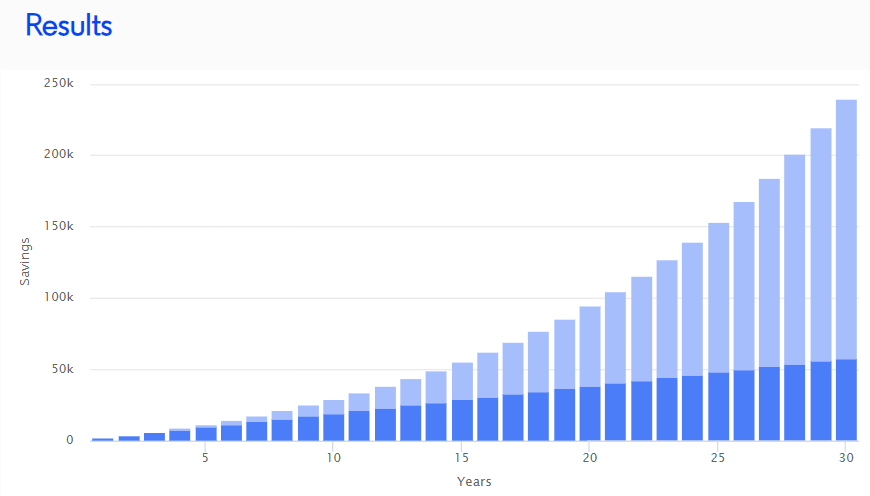

3. Invest in a broad-based share investment

If you were to invest $161 per month into a broad based share investment assuming 4% income & 4% capital growth and 100% reinvested (net of fees, brokerage & tax) = $239,948.

This would also pay dividends up to $10,000 a year that you don’t have to lift a finger for (i.e. fully passive).

How to get started?

Click here to book a free phone chat to talk about your specific situation.

Speak to a mortgage broker (we know a great one).

Follow us on our social channels for more content and ideas.

Cheering you on!

Certified Financial Planner®, Director

Download our Money Flow Playbook

Click here to download a copy of our Money Flow Playbook.

Download our Investment Playbook

Click here to download a copy of our Investment Playbook.

Book a free phone chat

Click here to book a free phone chat to talk about your specific situation.

Financial Advisor Geelong.

Important:

This is not tax advice. Your personal objectives, needs or financial situation have not been considered when preparing this information.

The information contained in this update has been provided as general advice only. The contents have been prepared without taking account of your personal objectives, financial situation or needs.

You should seek advice before making any decision regarding any information, strategies or products mentioned to consider whether that is appropriate to your own objectives, financial situation and needs.

Current as of 4 April 2024.